can you pay california state taxes in installments

In order to qualify you must have filed all income tax returns on time paid the income tax due and not requested an installment agreement for the prior five years. To qualify for a long-term monthly installment payment plan you must owe 50000 or less in combined tax penalties and interest.

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Depending on your tax situation you will be able to make payments in a number of ways.

. The Department will continue to send meaningless communications and conduct automated tax call campaigns to businesses to remind them of their commitments. By filling out the form the applicant adds the following information. However its best to act sooner rather than later.

Theres a 23 service fee if you pay by credit card. If these payments are not received within six months from purchase date Sales voucher Sales Form 53-1 a tax return would have been filed. Read complete answer here.

Amount due is less than 25000. If your request is accepted you will receive a notice with your monthly payment due date and amount. The highest rate is levied at income levels of at least 526444.

You can also request a payment plan online. The number is 916 845-0494. You can pay the amount in 60 months or less.

You can check your balance or view payment options through your online account. For each month quarterly or annual Sales Tax return you select this option to file and pay your taxes. Can I Pay My Taxes On Installments.

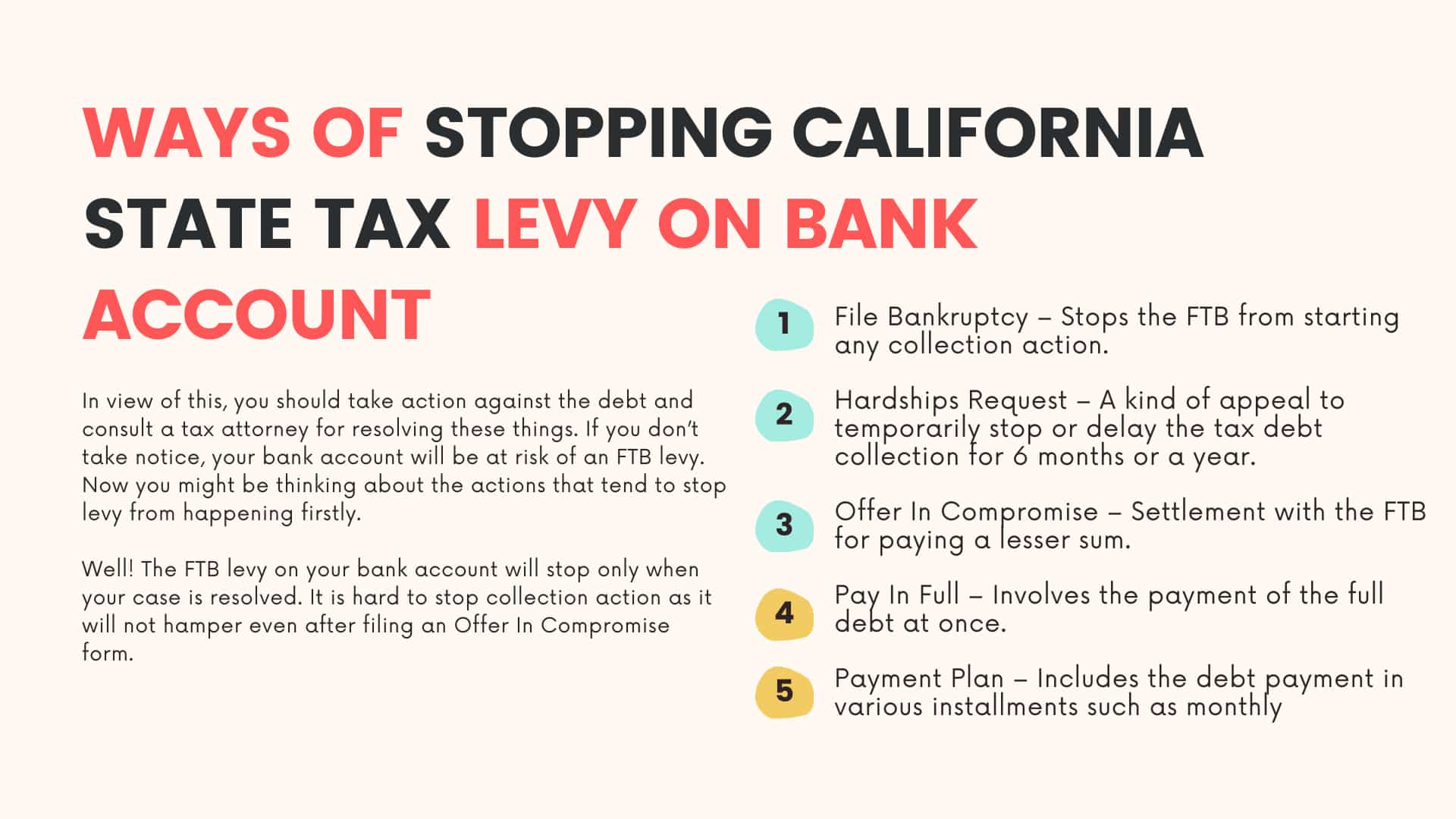

If you dont pay your California property taxes. California taxpayers have several options for paying off outstanding tax debts. Western Union charges a fee for this service.

How long do I have to pay my Georgia state taxes. The personal income tax rates in California range from 1 to a high of 123 percent. If you are unable to pay your public taxes you should work with the Franchise Tax Board FTB to agree on a California tax payment plan to request an extension or an offer to pay your tax debt.

Plus accrued penalties and interest until the balance is. Or call 800 272-9829. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

Apply by phone mail or in-person. Taxation of sales and use. 1250 PM EDT Apr 11 2022.

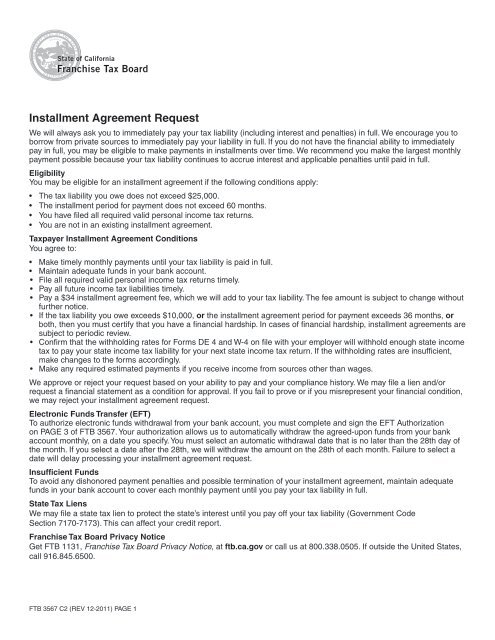

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. If you are unable to pay your state taxes you can apply for an installment agreement. Bill or other balance due.

It may take up to 60 days to process your request. Check or money order Mail your payment or pay in person at a field office. Installment agreement request If you are financially unable to pay the balance in full you may be eligible to make monthly.

Current year tax return. In California you generally have five years to get current on delinquent property taxes. 1 day agoKey Points.

If approved it costs you 50 to set-up an installment agreement added to your balance. An application fee of 34 will be added to your tax balance when you request an installment agreement. Typically you will have up to 12 months to pay off your balance.

If you cant pay your tax bill in 90 days and want to get on a payment plan. I have installments set up for my federal taxes but I did not see an option for California state taxes. You can make credit card payments for.

What happens if you cant pay property tax California. These are levied not only in the income of residents but also in the income earned by non-residents who are working in the state. CopyShortcut to copy Link copied.

If we approve your request we agree to accept monthly installment payments instead of immediate payment in full. The deadline to pay income tax in 2019 was July 15. The Individual Income Tax due date is coming up Monday April 18.

Under a Guaranteed Installment Agreement there is no minimum monthly payment as long as you pledge to pay off your balance within three years. The Late Payment penalty is 05 of the unpaid tax due and an additional 05 of the outstanding tax for each extra month. With full payment plans theres a short-term payment plan usually paying within 180 days or a long-term payment plan installing the loan on a permanent basis typically paying every month.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. You may be eligible for an installment agreement if. Its critical to file your return or an extension by April 18 to avoid a late filing penalty of 5 of unpaid taxes per month capped at.

Can California property taxes be paid in installments. An extra 1-percent surcharge is also levied onto incomes of more. If you owe taxes to the State of California but cant pay the full amount on time you may be able to set up a payment plan.

FRANCHISE TAX BOARD PO BOX 2952 SACRAMENTO CA 95812-2952. Usually you can have from three to five years to pay off your taxes with a state installment agreement. The due dates are set forth by state law and you must pay the taxes on those dates.

Pay now with ACI Payments. Article continues below advertisement Taxpayers owing between. A qualified tax advisor can help you.

Per Revenue and Taxation Code State of California Section 2703 the second installment of taxes may be paid separately only. Box 2952 Sacramento CA 95812-2952. State of California Installment Agreement Request Complete and sign this page.

You can request a payment agreement in instalments. The maximum is up to a maximum of 25 of the tax due. Importantly as soon as you know you cant pay back your taxes contact a tax professional.

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Additionally GA applies interest for each month or part of a month that a delinquent tax goes unpaid. Western Union Pay online by phone or in person at one of their worldwide offices.

Youve filed all your income tax returns for the past 5 years. Cant pay your tax bill and want to complete a payment plan. Apply online by phone or in-person.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

Installment Agreement Request California Franchise Tax Board

Irs Letter 4458c Second Installment Agreement Skip H R Block

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Secured Property Taxes Treasurer Tax Collector

Supplemental Secured Property Tax Bill Placer County Ca

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Second Installment Payments For 2019 20 Secured Property Tax Bills Are Due February 1st County Of San Luis Obispo

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Lease And Buy Agreement Real Estate Forms Real Estate Real Estate Contract

3 Proven Ways To Stop California State Tax Levy On Bank Account

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group

California Tax Payment Plan Get California Tax Help Today

Commercial Property Lease Agreement How To Create A Commercial Property Lease Agreement Download This C Lease Agreement Lease Agreement Free Printable Lease

Can I Pay Taxes In Installments

Property Tax Prorations Case Escrow

Sample Commercial Rental Agreement Rental Agreement Templates Room Rental Agreement Commercial